For small businesses, selecting the right accounting software is crucial to managing finances, simplifying daily operations, and ensuring long-term growth. With numerous options available, three of the most popular choices are QuickBooks, FreshBooks, and Xero. Each offers distinct features tailored to different business needs. Here’s a detailed look at each one to help you decide which is the best fit for your business.

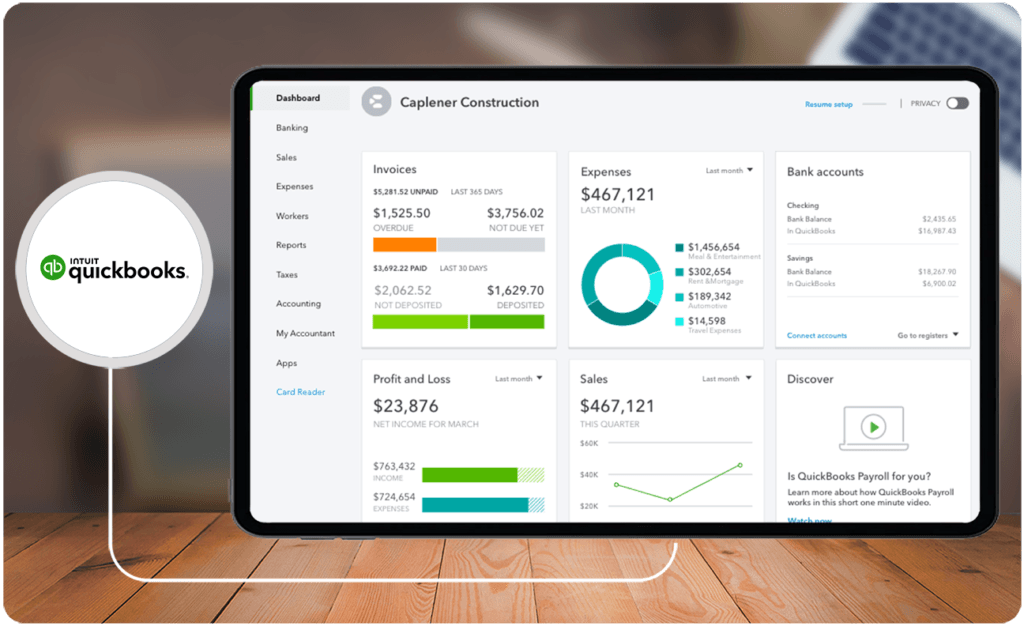

1. QuickBooks: The Ultimate All-in-One Tool for Growing Businesses

QuickBooks is a go-to accounting software for businesses of all sizes, offering a powerful set of tools that cover all aspects of financial management.

Key Features:

- Invoicing & Payments: Customize invoices, track payments, and accept online transactions effortlessly.

- Expense Tracking: Quickly categorize and track expenses for better financial oversight.

- Payroll Management: Automates employee payroll processing, tax calculations, and compliance.

- Tax Preparation: Generates reports to simplify tax filing and deductions.

- Cloud and Desktop Versions: Available both online and offline, QuickBooks gives businesses flexibility in how they manage their accounting.

Best For:

Businesses that need comprehensive tools for managing finances, from invoicing and expenses to payroll and taxes. QuickBooks is ideal for medium-sized businesses that are scaling and require a full suite of accounting features.

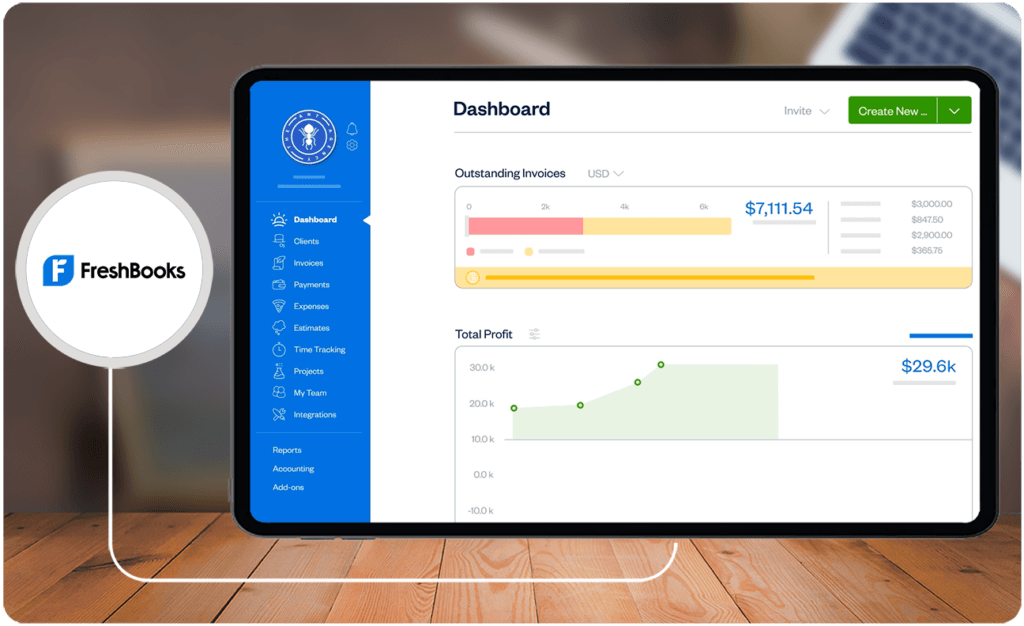

2. FreshBooks: Perfect for Freelancers and Service-Based Businesses

FreshBooks shines as an intuitive, user-friendly accounting solution, especially for service-oriented businesses or freelancers who need to manage clients, time, and billing with ease.

Key Features:

- Time Tracking: Perfect for businesses that bill clients by the hour, allowing users to track work hours and create precise invoices.

- Invoicing: Send polished, professional invoices with a click of a button and accept payments online.

- Expense Management: Automatically imports expenses and categorizes them for you.

- Mobile App: FreshBooks has a mobile app that lets you manage finances, create invoices, and track expenses while on the go.

Best For:

Freelancers and small businesses focused on providing services, particularly those who need to manage time tracking and invoicing. FreshBooks is designed to be simple, efficient, and user-friendly.

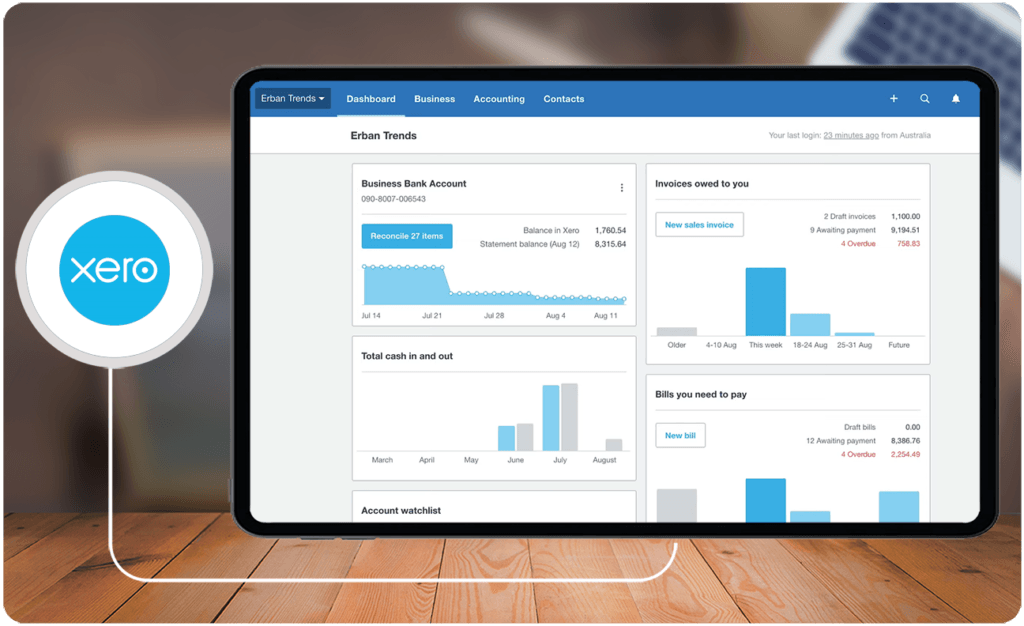

3. Xero: Scalable Accounting for Growing and International Businesses

Xero is a cloud-based accounting software that delivers flexibility and scalability for businesses that need more advanced features and the ability to grow.

Key Features:

- Bank Reconciliation: Automatically import bank transactions and reconcile them in real-time.

- Multi-Currency Support: Xero supports over 160 currencies, making it ideal for businesses that work with international clients or vendors.

- Invoicing & Quotes: Create and send customized invoices and quotes with ease.

- Payroll: Xero offers robust payroll features that sync seamlessly with tax systems.

- Third-Party Integrations: With over 800 apps available, Xero allows businesses to extend functionality as they grow.

Best For:

Growing businesses, particularly those with international clients or complex accounting needs. Xero is perfect for businesses looking for an adaptable and scalable solution.

How to Choose the Right Software for Your Business

When selecting accounting software, consider your specific needs, business size, and future plans:

- Ease of Use: FreshBooks is the easiest for freelancers and small service-based businesses to use, while QuickBooks has a bit of a learning curve due to its extensive features.

- Cost: FreshBooks is more budget-friendly for freelancers or businesses just starting. QuickBooks and Xero, while more expensive, provide more robust tools for businesses that need advanced financial management.

- Advanced Features: QuickBooks excels in payroll and tax management, FreshBooks is focused on invoicing and time tracking, and Xero shines with its multi-currency features and scalability.

Conclusion

In today’s fast-paced business environment, the right accounting software is key to streamlining processes and reducing errors. Whether you’re a freelancer, a growing small business, or a larger company with international needs, QuickBooks, FreshBooks, and Xero each offer unique advantages. By considering factors such as ease of use, cost, and specific needs, you can choose the software that will best support your business’s financial management for years to come.