There are many benefits to using a payment gateway for your business, one of which is making transactions easier between sellers and buyers. Below is a more complete explanation regarding payment gateways and the benefits and advantages of using them.

What is a payment gateway?

A payment gateway is a technology-based payment portal that enables transactions to be conducted anytime and anywhere. This payment system operates using an internet connection.

This payment system is specifically designed to integrate various payment instruments. In other words, if a company uses a payment gateway, both national and international transactions can be integrated seamlessly. There’s no need to worry, as this payment system is equipped with advanced security features, ensuring that all data is well-protected.

By leveraging an internet connection, this payment system makes transactions easier. You can make payments directly online without needing to visit a bank or meet with the seller or buyer.

How do payment gateways work?

For those who are still unfamiliar, the payment gateway system and how it works is very complex. Below is an explanation of how it works.

1. Consumers make transactions

The first step in a payment gateway is for the consumer to make a transaction. Consumers who decide to buy a product are given payment options. The payment gateway system you installed will appear as one of the payment options.

2. Passing information to the payment gateway

The information is then passed on as the payment gateway forwards the information from the first step to the payment source connection. For example, if a consumer chooses to transact using a bank transfer payment, the payment gateway will send that information to their bank.

3. Information received

In such cases, this information is provided to the card issuer, Visa and Mastercard. These two types of cards and payment gateways also connect consumers with other partner banks. Don’t worry. The payment gateway security system is safe from eavesdropping.

4. Custom code provided

Furthermore, after receiving information about the transaction to be carried out, the publishing association provides a response in the form of a special code. Only card issuers and payment gateway processors know this code.

5. Transaction successful

Once the code is received, the payment gateway company changes the consumer’s payment status to paid. The payment gateway payer then forwards the information to the installed merchant. Sellers can also send products directly or follow consumer transactions.

Payment gateway feature?

The existence of a payment gateway brings many conveniences to the community. The following are the various advantages of using this system:

1. You don’t need to have multiple accounts

With a payment gateway system, business people do not need many accounts to carry out transactions. When you use this payment, you are automatically connected to legal financial institutions and banks in Indonesia.

Read more: 5 reasons why digital payments via payment gateways are important for your business

2. More payment options

Carrying out transactions online makes the process easier. This transaction model allows for greater diversity in payment method offerings. As a consumer, you can choose from a variety of payment options.

3. Simplified payment summary

Those who use the best payment processors will find the payment and purchasing process much easier. These payments are automatically recalculated in real-time, making your financial management more efficient.

4. Wider reach

Relying on manual payment or purchasing systems limits your business access to just one location. This is different if you use a payment gateway because it allows you to develop your business abroad. The value of the products you sell will also increase because they have successfully entered the international market.

5. Complete transactions faster

This payment system allows you to complete all transactions more quickly. Whether you are a consumer or a business owner, you will not have to wait long to complete any payment transaction.

6. Ensure more security

Compared to traditional payments, payments using a payment gateway system are safer. Even with the development of this technology, your company will not experience data loss or leakage because we have various security systems to ensure all transactions. Of course, having a payment gateway offers huge benefits to businesses.

Read: Find out how payment gateway security systems ensure your business transactions.

7. No trading limits

Payment gateways offer seamless transactions to anyone. As a customer, you can transact without restrictions, anytime, anywhere, without complying with any nominal or transaction amount limits.

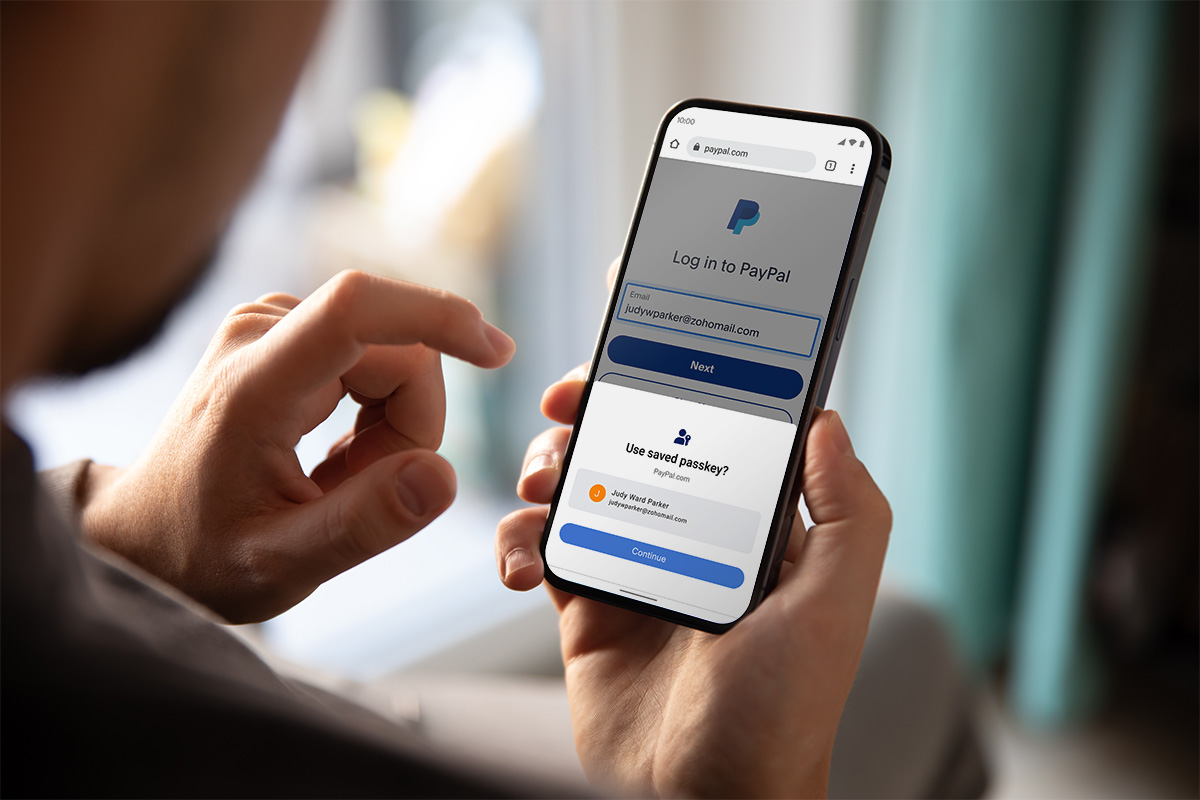

PayPal is One of the Best Payment Gateways in the World

This concludes the comprehensive explanation of payment gateways in the business world. Considering the crucial role of this payment system, it would be a missed opportunity if your company didn’t utilize it. There’s no need to worry, as PayPal Business is now available—a secure online payment method that can be integrated with your business website or app using API or plugins.

Top Payment Gateways to Watch in 2024: A Global Overview

1. United States

- Key Players: PayPal, Stripe, Square

- Challenges: Continuously changing regulations, intense competition, and consumer demands for fast and secure payment solutions.

- Opportunities: Adoption of new payment technologies such as cryptocurrency and contactless payments.

2. Europe

- Key Players: Adyen, Klarna, Worldpay

- Challenges: Implementing complex PSD2 regulations, which are changing how digital payments work across Europe.

- Opportunities: Growth of cross-border e-commerce and increased use of digital payments in Eastern European countries.

3. United Kingdom

- Key Players: Worldpay, PayPal, Revolut

- Challenges: Uncertainty post-Brexit, which affects cross-border operations and regulatory changes.

- Opportunities: Growth of fintech and innovation in digital payments, as well as an increase in B2B payment services.

4. India

- Key Players: Razorpay, Paytm, Instamojo

- Challenges: Varying infrastructure across regions and the need to reach the unbanked population.

- Opportunities: The Digital India Initiative and government efforts to create a cashless economy.

5. China

- Key Players: Alipay, WeChat Pay, UnionPay

- Challenges: Strict government regulations and oversight of major tech companies.

- Opportunities: Dominance in mobile payments and the continued growth of the digital economy in China.

6. Indonesia

- Key Players: Midtrans, Doku, Xendit

- Challenges: Low financial inclusion in rural areas and trust in online payments.

- Opportunities: Growth of e-commerce and adoption of digital payments among younger generations.

7. South Africa

- Key Players: PayFast, Peach Payments, Yoco

- Challenges: Limited access to internet and banking infrastructure in some areas.

- Opportunities: Financial inclusion and the development of digital payments for the unbanked population.

8. Japan

- Key Players: Rakuten Pay, Line Pay, PayPay

- Challenges: The prevailing cash-based habits of the population.

- Opportunities: Increasing adoption of mobile payments and development of contactless payment technologies, especially after the Tokyo Olympics.

9. Brazil

- Key Players: MercadoPago, PagSeguro, PayU

- Challenges: High inflation and economic instability that can affect consumer trust.

- Opportunities: Growth of e-commerce and increased adoption of digital payments by consumers.

10. Australia

- Key Players: eWAY, Stripe, Afterpay

- Challenges: Strict regulations related to consumer protection and data privacy.

- Opportunities: Increased adoption of digital payment technologies in retail and e-commerce sectors.

11. Nigeria

- Key Players: Flutterwave, Paystack, Interswitch

- Challenges: Limited technology infrastructure and low internet penetration.

- Opportunities: A large young population and the burgeoning fintech industry to serve the underserved market.

12. Russia

- Key Players: Yandex.Money, Qiwi, WebMoney

- Challenges: Strict regulations and government control over digital transactions.

- Opportunities: A rapidly growing e-commerce market, especially in major cities.

13. Saudi Arabia

- Key Players: Payfort, STC Pay, HyperPay

- Challenges: Strong cash-based traditions and the need for solutions that comply with Sharia law.

- Opportunities: Digital transformation and government initiatives to create a cashless economy as part of Vision 2030.

14. Singapore

- Key Players: PayPal, DBS PayLah!, GrabPay

- Challenges: A highly competitive market and the need to continuously innovate.

- Opportunities: Singapore as a fintech hub in Southeast Asia, with the adoption of advanced payment technologies.

15. Canada

- Key Players: Moneris, PayPal, Stripe

- Challenges: Strict regulations regarding data protection and privacy.

- Opportunities: A growing e-commerce market and increased adoption of digital payments.